Georgia stands out as one of the most veteran‑friendly states for taxing military and retirement income.

Military Retirement Pay Exclusions

- Under age 62: Veterans can exclude up to $17,500 of military retirement pay; qualified spouses can exclude an additional $17,500, allowing some married couples to subtract up to $35,000from taxable income.

- Bonus exclusion: Veterans who earn more than $17,500 in earned income can deduct an additional $17,500, potentially doubling the exclusion.

- Ages 62–64: Up to $35,000 per person.

- Age 65+: Up to $65,000 per person.

Other Retirement Income

- Social Security: Fully exempt from Georgia state tax.

- Taxable retirement income (other than excluded amounts) is taxed at a flat 5.49% rate.

Who Benefits? Veterans & Active‑Duty Numbers in Georgia

Active‑Duty & Reserve Military in Georgia

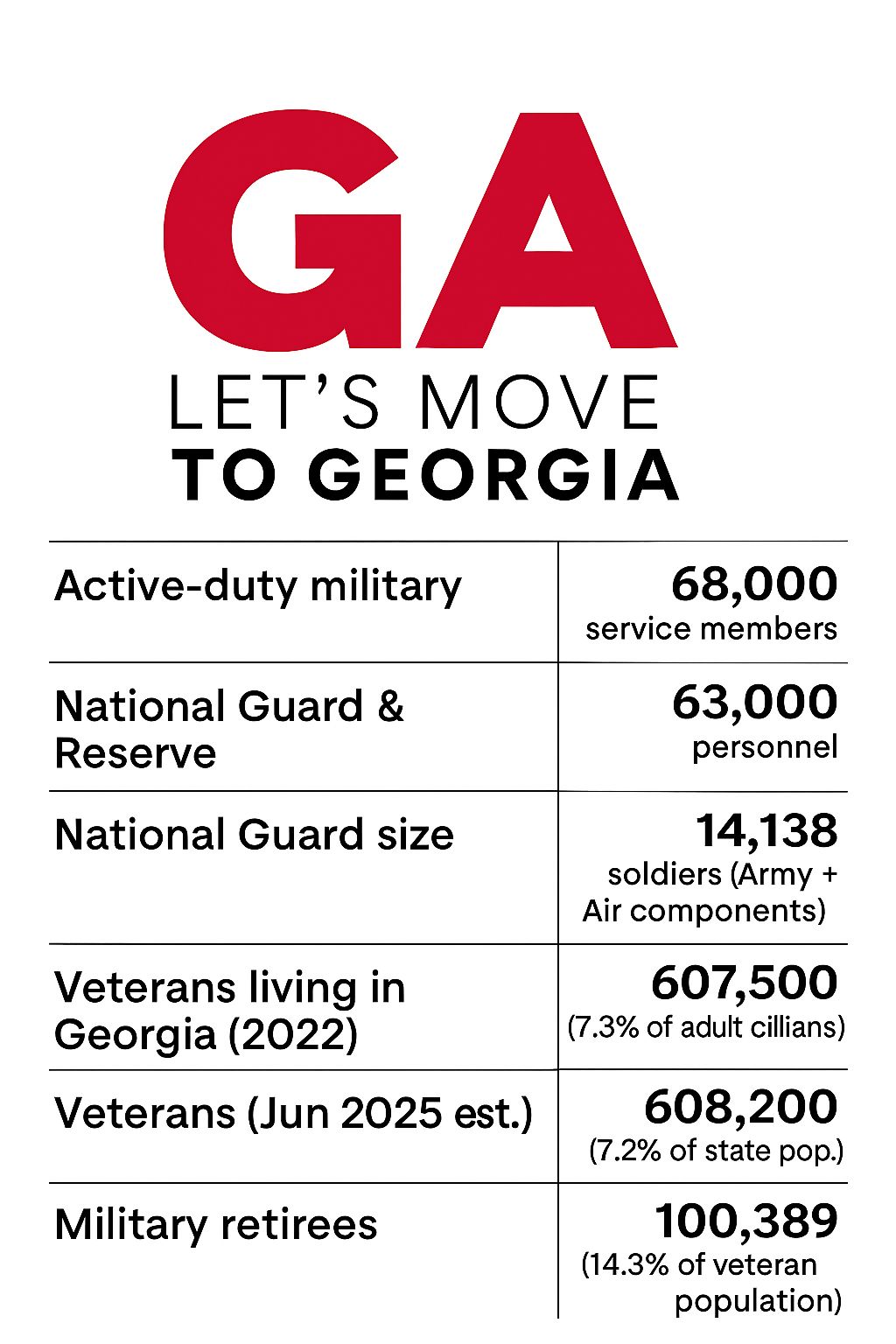

- As of around 2020 data, Georgia hosts approximately 68,000 active‑duty service members, plus about 63,000 National Guard and Reserve personnel (legis.ga.gov).

- The Georgia Army National Guard alone comprises over 11,100 soldiers, with an Air National Guard totaling another 2,844, bringing Georgia’s National Guard to roughly 14,138 members(en.wikipedia.org).

Veterans & Military Retirees

- As of 2022, about 607,500 veterans reside in Georgia, representing 7.3% of the adult civilian population. That is the 7th-largest veteran population among U.S. states (usafacts.org).

- Another estimate (June 2025) puts the veteran population at 608,198—roughly 7.2% of the state population, ranking Georgia 21st among states and territories (military.com).

- Among those veterans, approximately 100,389 are military retirees—accounting for 14.3% of the veteran population in Georgia (data.va.gov).

Why It Matters for Tax Planning

Many Georgians served actively in the military: with around 68,000 active-duty personnel and 63,000 reservists in the state, plus over 100,000 military retirees, a meaningful number of households may benefit from Georgia’s generous exclusions (legis.ga.gov).

Combined with the $35,000 – $65,000 tax exclusions per individual, these policies can significantly lower tax burdens for veterans and their families—especially for spouses and older retirees.

Georgia’s tax exclusions for military retirement pay and other retirement income remain among the most generous in the U.S., offering substantial relief to an estimated 600,000+ veterans and their families residing in the state.